Incremental margin formula

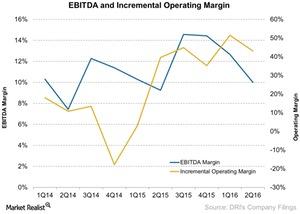

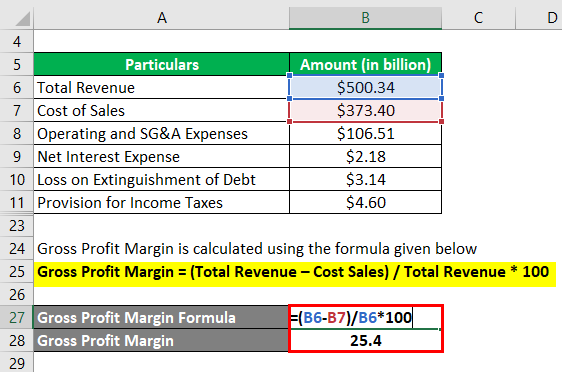

The gross margin is derived by the deducing Cost of Goods Sold COGS from the net revenue or net sales gross sale reduced by discounts returns and price adjustments. A companys incremental operating margin is calculated as the change in operating income divided by the change in revenue over a period.

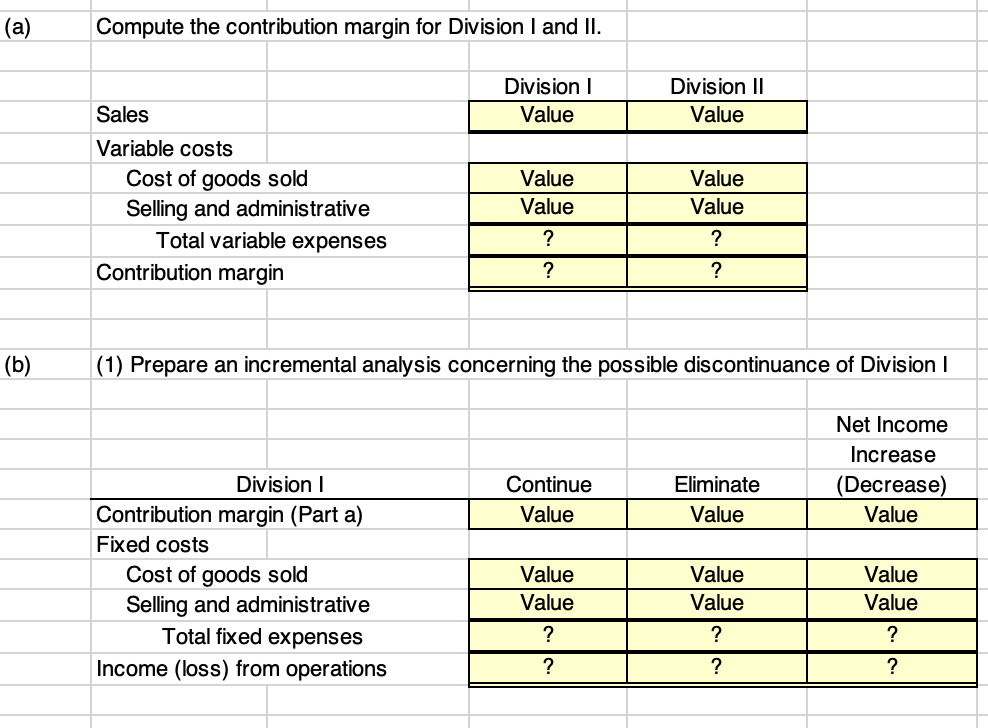

Incremental Analysis Accounting Fifth Edition Ppt Download

The formula used to calculate the CM would be as follows.

. When you want to calculate the incremental portion of EBITDA you take the difference between two periods. Total cost of producing two items - the total cost of producing one item incremental cost. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products.

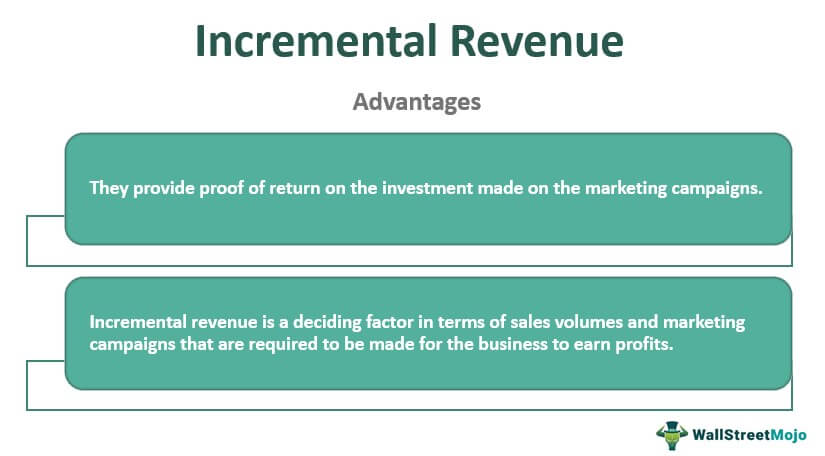

Here are the steps to calculate incremental cost. Businesses use incremental revenue to calculate. Incremental EBITDA Margin Formula.

The operating profit would be Gross profit Labour expenses General and Administration. Incremental EBITDA Margin Ending EBITDA Beginning EBITDAEnding Revenue Beginning Revenue Importance of Incremental. Contribution margin is the revenue from a sale transaction less all variable costs associated with that sale.

Incremental cost also referred to as marginal cost is the encompassing change a company experiences within its balance sheet or income statement due to the production and. Now we will deduct the operating expenses from gross profit to determine the operating profit. The phrase contribution margin can also.

Since incremental revenue doesnt account for overhead costs companies use it mainly to look at overall profit margins. An example would be a company had EBITDA of 220MM in. An incremental analysis is a decision-making technique used in business to determine the true cost difference between alternatives.

Next the CM ratio can be calculated using the following formula. 1500 2500 60. Incremental operating margin is the increase or decrease of income from continuing operations before stock-based compensation interest expense and income-tax expense between two.

Therefore calculating incremental cost is crucial for cost determination cost accounting purposes determination of profit margin financial planning and the overall. 2500 1000 1500. As a result estimating incremental cost is critical for cost determination cost accounting profit margin determination financial planning and overall profitability of.

The resulting margin represents the amount of cash that is available.

Solved P20 5a Prepare Incremental Analysis Concerning Chegg Com

How Darden S Incremental Margins Have Expanded

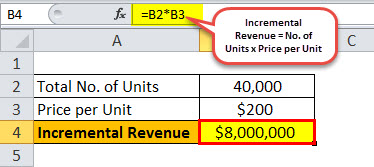

Incremental Revenue Definition Formula Calculation With Examples

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

How Do I Calculate An Ebitda Margin Using Excel

Incremental Margin Formula And Profit Growth Analysis Calculator

Mgt223 Chapter 4 Cost Volume Profit Relationships Team Study

Acct 2102 Sally Co Incremental Profit Analysis Class Activity Youtube

Profit Margin L Most Important Metric For Financial Analysis

Contribution Margin Formula And Ratio Calculator Excel Template

Incremental Revenue Definition Formula Calculation With Examples

Chapter 6 Incremental Analysis Study Objectives Ppt Video Online Download

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Formula And Ratio Calculator Excel Template

Incremental Margin Formula And Profit Growth Analysis Calculator

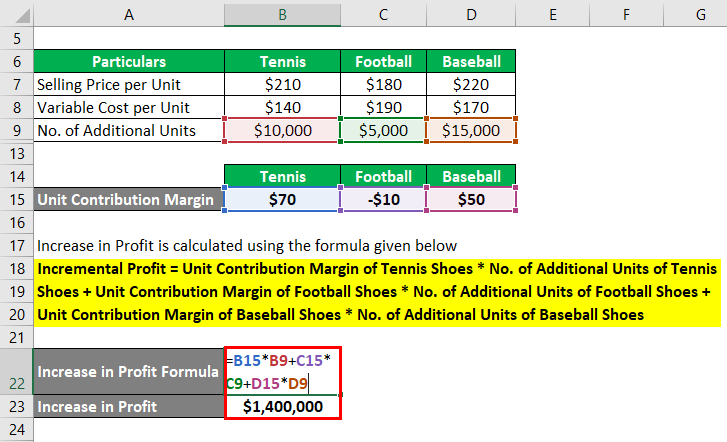

Unit Contribution Margin How To Calculate Unit Contribution Margin

Incremental Analysis Youtube